We'd all like more of this, yeah?

Well, I know that being a commuting college student who works part-time can mean a really, really tight budget.

I'm seeing all these commercials for "cash back rewards programs", but those are all for credit cards, something most of us really don't want to become entangled in.

So what's a girl to do?

I've given this more thought than I could afford to and came to this realization: most full-time students work more hours during the summer than during the actual school year.

This means that we're generally making money over the summer to last us during the "drought" so to speak.

So, how do we make sure that we're saving enough for the important things like textbooks, car insurance, and rent?

First, the homemade cash back rewards program.

I'll admit it: this is more or less a result of my laziness and unwillingness to carry around change, but hey, it works.

Make all planned purchases in cash.

This means groceries, makeup, clothes, and other things that you'd typically put on a shopping list.

Here's how the cash back works: take the change* you've gotten back from the purchase and stash it away for later. This can be a Black Friday fund, a rainy day fund, an emergency fund (which is probably the wisest, especially if you're living off your own means).

*(When I say "change", I mean the actual coins, but it's up to you what you stash away -- it can be anything less than a $5, less than a $20, whatever works for you in your current situation.)

Second, save money online.

This is a lifesaver for those of us that buy and rent textbooks and such online: Ebates. I know it sounds like a scam, but it's not; I signed up and have already gotten a "big fat check".

This is how Ebates works: you go to their site and search for the store you want to shop at, say Chegg.

You'll see that Chegg has a 4.5% cash back value; this varies per store.

All you have to do is click "Shop Now", and you'll be rerouted to that site. Shop as you would normally, and a percentage of your price will be put back in your pocket!

Ebates also has coupon codes for sites, so those are worth looking into as well. (RetailMeNot also has coupon codes. Very handy indeed.)

Third, be smart when shopping for textbooks.

Of course it's easier to just check Amazon and Half.com for textbooks, but I've found that those aren't always the cheapest places to get them.

Here are some other sites you'll want to check as well:

AbeBooks

Bookrenter

Chegg

Ecampus

Textbooks.com

Also, when you're planning to buy books, get them as early as you can. Most people sell their books at the end of the semester, which means there will be a large supply, usually lowering the cost. This also means that if you're planning to sell, wait until a week or two before school begins; those who have procrastinated will be hunting the books down and most will already be sold out.

If you're planning to rent, you'll learn that some sites offer books for a "semester", while others simply offer 60, 90, and 125 day periods. Calculate how long you'll need the book (fall semesters generally end the first week of December while spring semesters typically last until the first week of May), and rent the book as early as possible to keep your cost down.

Fourth, take advantage of gift cards.

When somebody gives you a gift card, it's usually the best gift ever.

But what if you don't like the restaurant, or there is no store around you to use it in?

Simple: sell the card or trade it.

How?

Plastic Jungle.

You can sell unwanted gift cards and buy discounted gift cards to places you actually like. This is also a great way to save even more money on sales, too.

Fifth, spend some time budgeting.

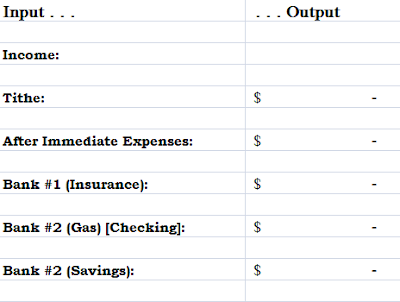

I know it's a pain, but it really comes in handy. Whether it's making an Excel Worksheet, keeping a ledger, using Mint, or what have you, it's a good skill to learn. Here's what my Worksheet looks like:

All I do is enter my income and my formulas do the rest for me.

10% is taken out for a tithe.

The tithe plus any other immediate bills (textbooks, loans from parents) is subtracted from the net income to give me my subtotal.

Now, my car insurance is taken out monthly from my savings account at Bank #1, so that's pretty much all I use that account for. 60% of the subtotal is deposited there.

At Bank #2, my savings is (theoretically) untouched (read: emergencies) and my checking is primarily for gas, as I commute to school instead of live on campus. 25% of my subtotal is deposited into checking for gas, and the remaining 15% percent is put in savings.

Obviously, this can be tailored to what you think is best for your specific situation.

Also, if you want this Worksheet, just email me and I'll get it sent to you.

And finally, be open to making money on the side.

This can include blogging / being sponsored, making things to sell on Etsy, babysitting, self-publishing stories, pretty much whatever! Just don't get too caught up in the income part of it (Proverbs 31: 10-31).

If you have any other tips for how you save money or work your budget, leave a comment below!

When getting your books compare the prices on a website that will give you prices and shipping of both buying and renting books! I use booksprice.com and then search for coupon codes and use Ebates if possible! This was such a good post for college students!

ReplyDeleteBooksprice . . . never heard of it, but it's bookmarked for next semester! Thanks Aimee!

DeleteI have read good things here. Definitely worth to bookmark again. I am amazed at how much effort you put into creating such an informative website. download post utme past questions for unichris

ReplyDeleteHi,

ReplyDeleteReally great article!!

Also read about Cloudbox99 offers you with the best hosting services and facilitates enterprises to transform digitally.